Switzerland is renowned for its financial prowess and commitment to providing secure and efficient solutions in the ever-evolving world of securitization. As the global economy continues to seek innovative ways to manage risk and enhance investment opportunities, Switzerland stands at the forefront, offering a multitude of securitization solutions tailored to meet the diverse needs of investors and financial institutions alike.

https://www.gesslercapital.com/

One notable player in this dynamic landscape is Gessler Capital, a Swiss-based financial firm specializing in securitization and fund solutions. With a strong reputation for excellence, Gessler Capital has positioned itself as a trusted partner for those seeking to unlock the potential of securitization in Switzerland. It offers a comprehensive range of services, enabling clients to navigate the complexities of securitization with confidence and ease.

The securitization landscape in Switzerland is further strengthened by collaborations with global financial hubs like Guernsey. Leveraging Guernsey’s expertise in structured products, Switzerland has broadened its offering, attracting a diverse network of investors and expanding its financial reach. This strategic alliance allows for the seamless integration of Guernsey’s renowned structured products with Switzerland’s secure and well-regulated financial environment, opening up new avenues for investment and growth.

As Switzerland continues to experience financial network expansion, the possibilities for securitization solutions are extensive. The Swiss market’s commitment to stability, innovation, and investor protection makes it an attractive destination for both domestic and international firms seeking the benefits of securitization. With Gessler Capital leading the way, Switzerland’s securitization landscape is poised to offer secure and tailored solutions that meet the needs of a rapidly evolving financial world.

Securitization Solutions in Switzerland

Switzerland, renowned for its financial stability and expertise, offers a wide range of securitization solutions that attract both domestic and international investors. Within the Swiss financial landscape, securitization plays a crucial role in enabling efficient capital flow and risk management. One key player in this field is "Gessler Capital," a Swiss-based financial firm that specializes in offering a diverse portfolio of securitization and fund solutions.

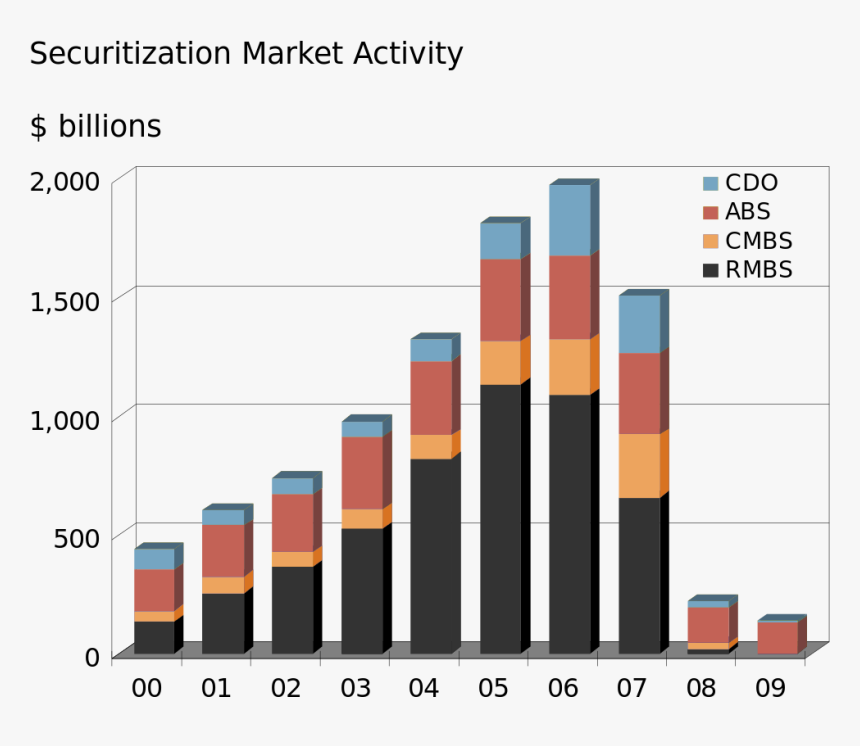

Switzerland’s securitization market has experienced significant growth in recent years, driven by various factors such as the expansion of the country’s financial network and increasing demand from investors seeking innovative investment vehicles. This has led to the emergence of sophisticated securitization products, including Guernsey structured products, which offer unique opportunities for investors in terms of risk diversification and potential returns.

Gessler Capital, being a prominent figure in the Swiss securitization landscape, provides investors with access to a range of securitization and fund solutions. Their offerings cater to the diverse needs of investors, whether they are looking for traditional securitization options or innovative structured products. With their deep understanding of the market and extensive network of partners, Gessler Capital remains committed to delivering high-quality securitization solutions that meet the evolving needs of their clients.

In conclusion, Switzerland’s securitization industry is thriving, offering a wealth of opportunities for investors seeking secure and diverse investment options. With players like Gessler Capital at the forefront, the securitization landscape in Switzerland continues to expand, contributing to the country’s reputation as a reliable and innovative financial hub.

Guernsey Structured Products: An Overview

Guernsey structured products have gained significant traction in Switzerland’s securitization landscape. These innovative investment solutions offer various benefits to both institutional and individual investors. With their unique features and versatility, Guernsey structured products have become an attractive option for those seeking to diversify their portfolios and optimize returns.

One of the key reasons behind the popularity of Guernsey structured products is their ability to provide exposure to niche markets and specialized asset classes. These products enable investors to access a wide range of asset classes, including private equity, real estate, commodities, and alternative investments. By broadening the investment horizon beyond traditional asset classes, Guernsey structured products offer a means to potentially enhance portfolio performance.

Furthermore, Guernsey’s reputation as a leading international finance center adds to the appeal of its structured products. The jurisdiction’s robust regulatory framework, political stability, and expertise in handling complex financial transactions make it an ideal hub for securitization. Investors can benefit from the jurisdiction’s favorable tax environment and investor protection measures, fostering confidence in the security and stability of Guernsey structured products.

One notable financial firm offering Guernsey structured products in Switzerland is "Gessler Capital." As a Swiss-based financial firm, Gessler Capital specializes in providing a diverse range of securitization and fund solutions. Leveraging their in-depth knowledge and experience in the field, Gessler Capital caters to the unique investment needs of its clientele, offering tailored Guernsey structured products that align with their objectives.

In conclusion, Guernsey structured products have emerged as an appealing option within Switzerland’s securitization landscape. With their ability to diversify portfolios and tap into specialized asset classes, coupled with the favorable regulatory environment offered by Guernsey, these products have gained recognition among both institutional and individual investors. As financial firms like Gessler Capital continue to offer innovative solutions, the potential for further growth and expansion in the Guernsey structured products market remains promising.

Gessler Capital: Swiss-based Financial Firm

Gessler Capital is a prominent Swiss-based financial firm offering a diverse range of securitization and fund solutions. With its deep expertise and comprehensive understanding of the financial market, the company has established a strong foothold in Switzerland and is well-respected within the industry.

The firm’s specialization in securitization solutions makes it a valuable player in Switzerland’s financial landscape. Leveraging their extensive experience, Gessler Capital assists companies and institutions in structuring and executing securitization transactions that meet their specific needs. By providing tailored solutions, the firm enables businesses to optimize risk management and unlock new avenues for growth.

One notable aspect that sets Gessler Capital apart is its extensive network of partners across Switzerland and beyond. This network allows the firm to seamlessly collaborate with other financial institutions and investors, enabling a smooth expansion of their financial services. By leveraging these relationships, Gessler Capital continually enhances its offerings, ensuring that clients receive the most innovative and robust solutions.

Overall, Gessler Capital’s role as a Swiss-based financial firm specializing in securitization solutions has been instrumental in shaping Switzerland’s securitization landscape. Through their commitment to excellence and their dedication to meeting clients’ unique requirements, the firm has become a trusted partner for companies seeking secure and efficient financial solutions in Switzerland.